Success Story

Processes Turn-Around Time reduced by 30% for SUCO Bank

Customer Brief

SUCO Souhardha Sahakari Bank (SUCO) is one of the fastest-growing co-operative banks of Karnataka with a vision that customers must have all the latest technology-driven services available to them. SUCO bank started its operations in the year 1995 and is into personal, agricultural, and business banking. The bank has 29 branches spread across North Karnataka with Head office situated at Bellary.

Challenge

In addition to the core banking processes, SUCO Bank followed many other processes which were unique to its organization. For example, a monthly appraisal management system based on set goals and targets, lead management, procurement management and more. These processes were either email or paper-based, making them error-prone, slow, and non-transparent.

The turnaround time for these processes was long because of the manual handling and the bank was looking for a solution to reduce this time.

There were a number of ready-to-use software available in the market for every process, but being a non-IT organization, instead of buying a different solution for each process which may or may not be configurable as per the bank’s needs, SUCO wanted one general-purpose automation platform that could be used to automate all processes as per their unique needs and become their single source of truth for all the information. This would mean that the bank would have to manage only two platforms – one for core banking and another one for all remaining applications.

Solution

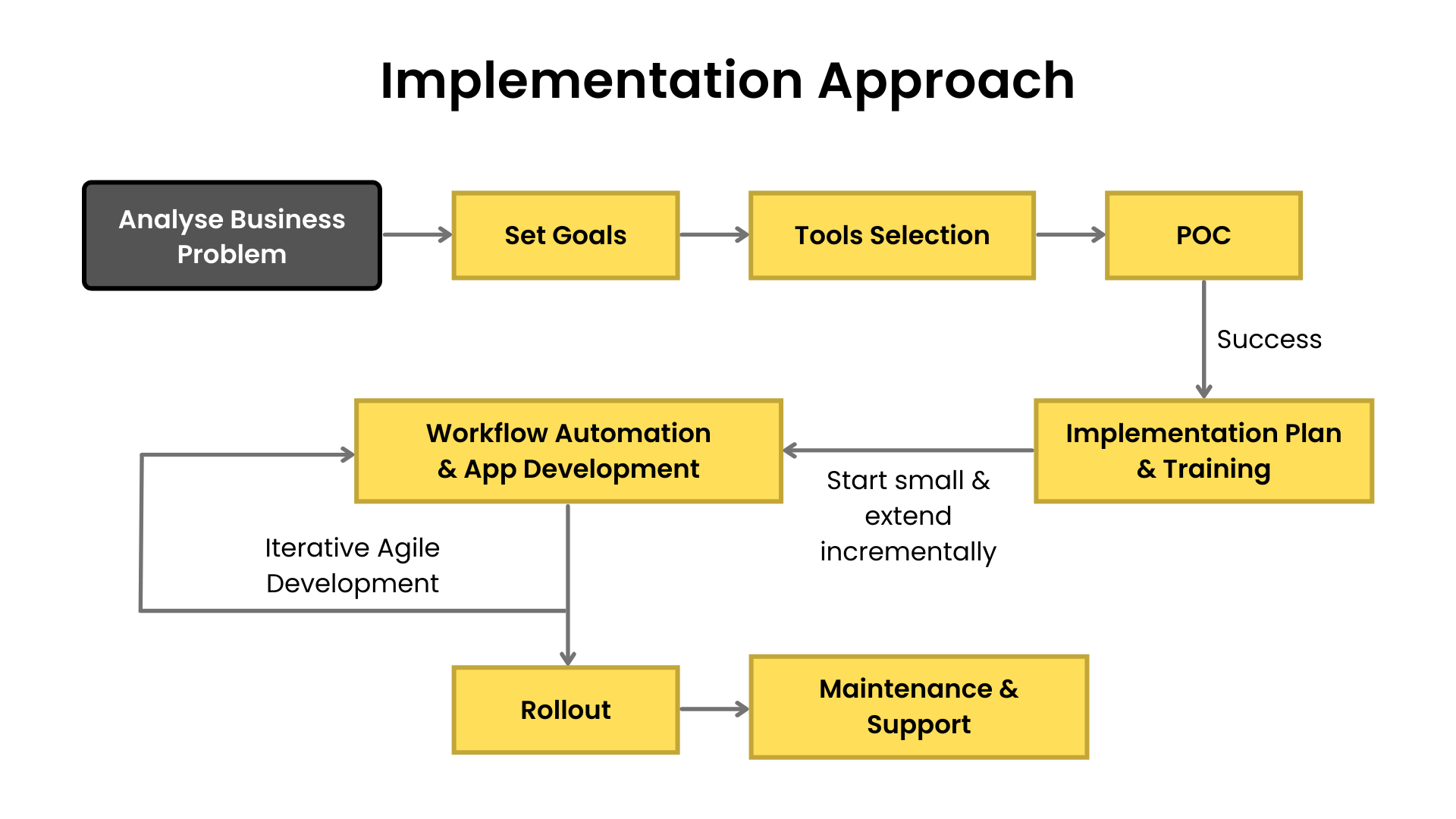

After a thorough market study, SUCO decided to evaluate Quixy as a general-purpose no-code platform. They started with a PoC which was completed within a week to SUCO’s satisfaction. SUCO then adopted an agile citizen development approach to automate various processes on the Quixy platform. Each sprint either involved enhancements to the processes already automated in the previous sprint or new processes altogether. The implementation team involved Quixy platform consultant, process owners and citizen development team from the bank.

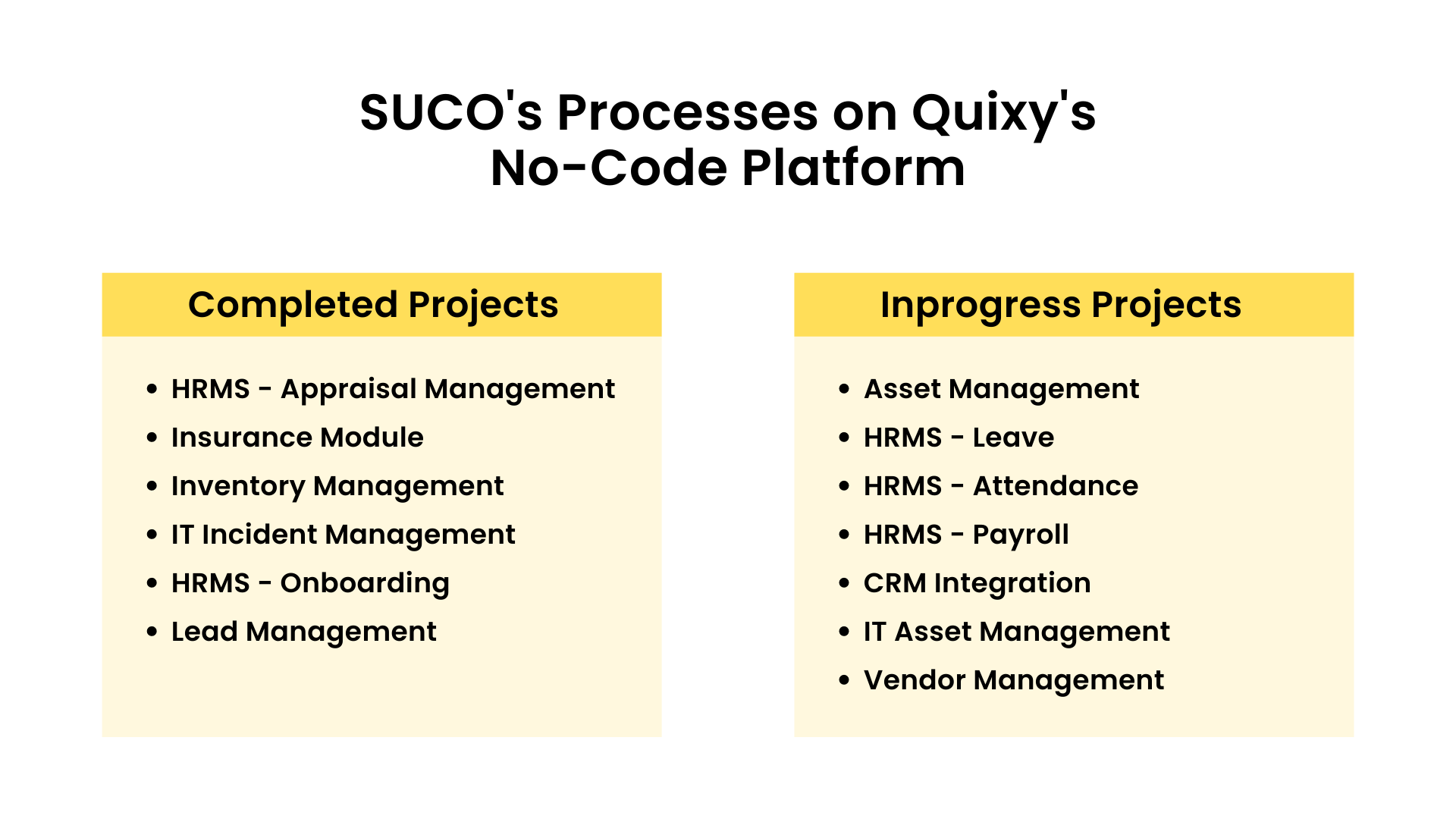

So far, processes such as HRMS Appraisal System, IT Incident Management, Inventory Management, and Insurance Module have been automated and deployed. Processes such as Asset Management, HRMS Leave Management, CRM integration, IT Asset Management etc have been targeted for implementation in the coming weeks. Using the role and access permission settings, process owners for each process have been given access to make necessary changes to the apps which may include changes to form data, workflow steps, business rules and access to information. The apps are seamlessly integrated to ensure no data redundancy, and Quixy remains the single source of truth for all data.

Benefits Galore

With Quixy, SUCO has been able to automate all its non-core financial processes on one single platform. Users are able to make changes to these apps and deploy them easily and swiftly. The IT team has to now manage only one platform instead of multiple COTS applications. Because of the automation of manual, paper, and email-based processes, the process turnaround time for applications like Appraisal Management has reduced by 30%.

Other Case Studies

Quixy rated as the top No-Code platform by users